Tax Deduction/ Exemption TDS on PF Withdrawal, EPF Saving Tips. No Tax Deduction for PF Withdrawal of up to Rs.50,000 from June 1st.

The Government has notified that, raising the threshold limit of PF withdrawal amount from 30,000/- to 50,000/-. Under the “Finance Act, 2016 amended section 192A of Income Tax Act, 1961 to raise the threshold limit of PF withdrawl from 30k to 50k for tax deduction at source TDS. These provision will come into effect from June 1, 2016. There are some provisions related to TDS, employee’s will exempted to pay the TDS on withdrawl of EPF amount from their own account.

Tax Deduction/ Exemption/ TDS on PF Withdrawal, Benefits of Employee’s EPF Account :

- TDS will not be deducted in case of transfer of an amount from one account to another account.

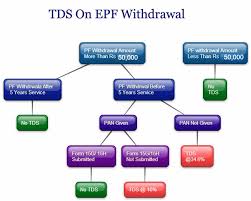

- If an employee withdrawal PF after a period of 5 years period, there will be no tax deducted.

- When an employee has submitted Form 15G/ 15H, then TDS is not deducted. Because these are declaration forms, means that their income would not be taxable.

- When an employee discontinues/ not doing the job due to health problem, they will be exempted from TDS.

- When an employee working in contractual basis/ working on project, there will no TDS. These employee’s can

- withdrawl the PF amount after completion of contract/ project.

And also, an employee can closed their business, at the time there is no TDS deducted.

Tax Deduction/ Exemption Rates TDS on PF Withdrawal Amount

- EPF account holder/ existing provisions can withdrawl more than the limit of their own amount on with submitting of PAN card details and 15G/ 15H forms, they can pay the TDS rate at 10 percent.

- TDS is deducted at the maximum marginal rate of 34.608 percent, if an employee fails to submit PAN of Form 15G / Form 15H.

- However, EPFO has given certail exemptions to deduction of TDS.

- TDS will be deducted under section 192A of Income Tax Act, 1961 at the time of payment on PF amount.

- Both the forms of 15G and 15H are self declaration forms.

- 15G Form is for below 60 years of age and have no taxable.

- 15H Form is for senior citizens of 60 years and above of age.

When, an employee has not completed their 5 years working service, they can withdrawal the amount of less than 50,000/- from their PF account. In case of an employee can withdrawal more than/ equal amount of 50,000/-, they can submit the form of 15G/ 15H and PAN card Details.

- For more details visit EPF official website at epfindia.gov.in