Calculate PF Amount for Salaried Government/ Private Employees. Calculate Interest rates on EPF. How to calculate PF amount for Employees.

Employee provident fund is under the government control and is run to the benefit of the employees. Both the employee and the employer will contribute to the employee provident fund and the total aggregate amount of the employees provident fund will be given to the employee after once the employee get their retirement. The employee provident fund will always work for the employees benefit and it is a huge amount for the employees to spend their life after their retirement. The employee provident fund is run by the employee provident fund organization, and always will strive to strengthen the relationship between the employees and the employer.

The employee provident fund organization will provide various services to its employees; it makes sure that the employees are not exploited by the employer in some or the other ways. It helps the employees for easy transfer of the EPF account from one employer to another employer.

calculate PF Amount

The fund has the total aggregate of the contributions that are made equally by both the employee and the employer. The employee provident fund organization will make the fluctuations in the interest rate. Employee will contribute 12% and the employer will contribute 12% of their basic pay to the EPF fund. The below is the article defining you all the employee provident fund calculation and also the interest calculation. Go through the article completely to have a clear idea about EPF fund calculation.

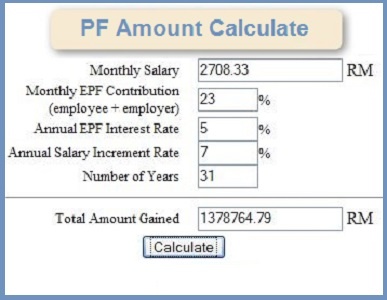

A method is to be followed to calculate the provident fund amount for salaried employees or the private employees.

Calculate PF Amount for employees, Check EPF Interest Rates

The contribution made by the employer is divided as per the below ways:

3.67% – Employee Provident Fund.

8.33% – Employee Pension Scheme (EPS).

0.5% – Employees Deposit Linked Insurance Scheme (EDLI).

0.01% – EDLIs administrative charges.

The below is the easy calculation for provident fund account:

If the person’s salary is 10000 then the provident fund is calculated as below:

- Employees monthly basic salary + Dearness Allowance: Rs.10000/-

- Employee contribution toward EPF will be 10000* 12% = 1200/-

- From the employer’s contribution the 12% will be divided to 3.67% of the amount contributed to EPF and 8.33% will be contributed to the EPS. Hence the employee provident fund contributed will be 10000* 3.67% = 367/-

These two amounts will be summed up to become the employee’s monthly contribution by both the employee and the employer.

For every month the interest for the amount in the account is calculated and then it is added up to the EPF account. For the first month starting, the amount in the account is zero at the starting of the month and so the interest for that month will also be zero and in such case, the second month interest will be calculated basing on the amount that is there at the end first method.

Hope the article is useful and is informative and you have gained some information regarding the calculation of the employees EPF. Do follow the page for more details about the employee provident fund and the organization.

Leave a Reply