EPF Interest Rate Lowered to 8.5% on PF Deposit for 2019-20. EPFO cuts Interest Rate from 8.65% to 8.55% fro 2017-18. PF Interest Rate cuts to 8.55% for 2017-18 from 8.65% for 2016-17.

EPF which is nothing but the lump sum amount given to an employee while he/she is leaving the organisation i.e. Employee provident fund and it is different from pension fund. This was governed by EPFO – Employees Provident Fund Organisation (EPFO). Read the article completely to know more about the EPF interest rate for the financial year 2019 -2020.

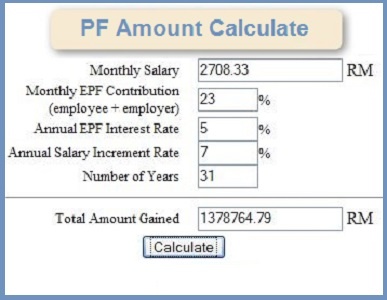

On 6th March,2020, EPF has reduced the interest rates for this fianancial year 2019-20. According to an official from labour ministry, Employees’ Provident Fund Organisation (EPFO) is likely to lower interest rate on provident fund deposits for this fiscal 8.5% per cent provided to its members during 2019-20. EPFO has reduced interest rate on deposits to 8.55% for the financial year 2017-18 from 8.65% for 2016-17.

EPF Interest Rate for FY 2019-20

Labour Minister Santhosh Kumar Gangwar said that the new interest rate will result in surplus of of over 700 crore rupees for the current financial year. The exact words of Santhosh Kumar Gangwar were “Last time, we had given interest rate that exceeded people’s expectations. But, keeping everything in mind, there is no shortage of money but we have decided to fix interest rate at 8.5% so we don’t face any issues in future. The finance ministry has been reportedly nudging the labour Ministry for lowering the EPF interest rate. The EPFO has investments of more than 18 lakh crore. Lowered rates on PF could be a direct result of the economic slowdown. The earnings on long term fixed deposits bonds and government securities are down 50-80 basis points in the last one year.

It is noteworthy that recently, EPFO approved an accounting policy for valuation and accounting of equity investments which was formulated in consultancy with IIM Bangalore.

EPF Interest Rate 8.55% on PF Deposit for 2017-18

As EPFO is planning to directly credit units of Exchange Trade Funds (ETF) into provident fund accounts which may result in lower yields on other investments more particularly bonds, interest rate cut is likely to happen.

However, the official added that EPFO is yet to work out the income projection for the current fiscal based on which interest rate cut will be decided.

The policy is to enable the EPF body to credit ETFs units into the provident fund accounts of the subscribers by the fiscal end, thereby to enable every account holder to see his/ her provident fund balance in the form of cash balance and ETF units.

Members of EPFO will only be able to realize the entire returns on the equity linked investments at the time of withdrawals even though the dividends on ETFs are credited into the subscribers’ accounts on timely basis.

At the same time, subscribers will also have an option to withdraw money while taking advances from their accounts, by liquidating ETF units or from cash component.

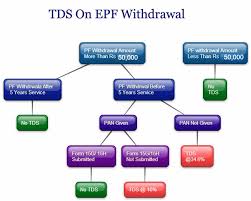

The finance ministry has been pushing the labour ministry to adjust the EPF rate at per with its small saving schemes like public provident fund. In the month of February 2018, the trustees of EPFO had decided to lower the rate of interest on EPF to 8.55 per cent for 2018-19 from 8.65 per cent provided for 2016-17. In case, the TDS rates are changes we will intimate you. Keep visit our website at epfbalance.net for latest information..

- For more details visit EPF India official website at epfindia.com