EPFO UAN Login Procedure, How to login into UAN Member Portal for the First Time at unifiedportal-mem.epfindia.gov.in, How to get UAN Member Portal Login Details.

Employees’ Provident Fund Organization (EPFO) has allotted a 12 digit Universal Account Number for the employees contributing to the Employee’s Provident Fund (EPF). All the services of EPFO are linked with this 12 digit Universal Account Number (UAN). This universal number is a unique number. so, all EPF members/ holders don’t forget/ avoid this number. When you changing your job, the UAN number can not be changed.

At the time of changing your job, go and contact the current employer. The employer will request to the EPFO to generate a new member ID for you. In case, if you forget/ lost the UAN, we have also provided the procedure on how to get the UAN forget Password. If you forget/ lost your password click on below link and get your password.

How to Change/ Reset EPFO UAN Login Password, Get your UAN Password

How to login into UAN Member Portal at unifiedportal-mem.epfindia.gov.in

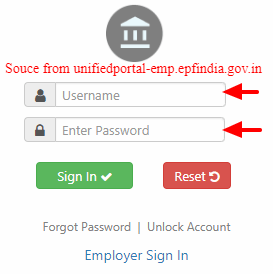

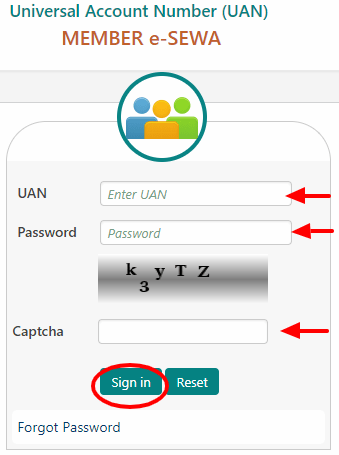

First of all go to UAN Login Page for accessing UAN Member Portal at unifiedportal-mem.epfindia.gov.in/,

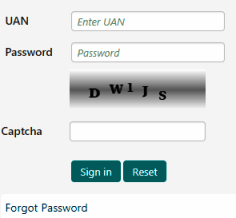

In that page you can see the login form (Placed at the Right-side), you can see the image in below.

Enter your 12-digit UAN, Password and Captcha characters, then click on ‘Sign in’ button,

If you forget your password click on ‘Forgot Password’. For more details on Forgot password, we have provided a link on above. Click on the link and follow the instructions..,

- For more details, visit the EPF India official website at https://epfindia.gov.in