EPF NPS SCSS PMVVY Scheme,Pension Plans for Retirement. Which scheme is the best for retirement? Senior Citizens Saving Scheme, Pradhan Mantri Vaya Vandana Yojana, National Pension Scheme, Employee’s Provident Fund.

Below is the just the overview of the various monetary benefits that are available to the senior citizens after their retirement.

Pension Plans for Retirement

Senior Citizens Saving Scheme (SCSS):

Senior citizens saving scheme is one of the best plans for the senior citizens who wants to have a regular income. Through this scheme, the senior citizens can invest their amount of money in the recognized banks or post offices. Any salaried person who has crossed the age of 60 can invest in this scheme. There is a age exemption for the defence retired personnel i.e they can invest after the crossing the age of 50 years. This scheme offers periodical interest to the on the amount deposited to the senior citizens. At present the interest rate provided to the senior citizens is 8.7%

To can registered for this scheme, people are required to go through certain documentation which includes basic documents like Aadhar card and pan card. The maximum amount that can be invested in this scheme is 15,00,000 and the minimum amount is the amount that individual received as retirement benefit. Under this scheme one can also get tax exemption upto an amount of 15 lakhs.

Pradhan Mantri Vaya Vandana Yojana (PMVVY)

This scheme has been launched in the year 2017 and has been providing the investors a good rate of return. This scheme is for a time period of 10 years and the beneficiaries can get the benefits throughout the years. The interest amount will be credited to the individuals account as per the policy selected by the individual at the time of registering for the scheme. If an individual has selected monthly policy then the interest amount will be credited to the beneficiaries account at the end of every month.

The main advantage under the scheme is that the individuals can get a fixed interest rate of 8% no matter what fluctuations the interest in the market goes through. The scheme is very much useful for the senior citizens as they will get the fixed amount of money at regular intervals without any hassle. This scheme also includes after death services. Where in the principal amount after the individual’s death will be given to the dependent person.

National Pension Scheme (NPS):

The national pension scheme provides security to the senior citizens by providing regular income. This scheme provides monetary security to all the citizens of India. Under this scheme there are 2 types of accounts that people can opt for which includes the tier 1 and tier 2.

Tier 1 is the policy where the individual can invest and there is limit on the withdrawal amount. Where as the tier 2 account doesn’t have any withdrawal limit on amount.

Employee’s Provident Fund (EPF)

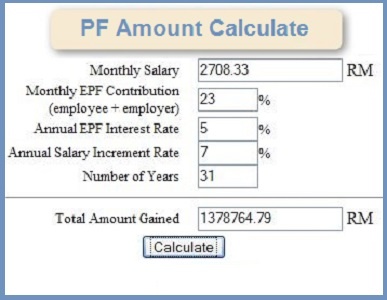

Employee provident scheme is one of the schemes for the retired people wherein the individuals can get to save money from the time they earn. A portion of their salary will be deducted and will be saved for later for after retirement benefit. In the same way, the employer also contributes some portion of amount and the entire amount from both contributions will be paid to the scheme by the employer and the fruits of this scheme will be enjoyed by the individual after retirement.

The above is the various schemes for pension plans to the senior citizens after their retirement. The EPS scheme is one of such that people earn more can save more for retirement and as such. The Pradhan mantri Vaya Vandana Yojana also provides a fixed amount of money instead of the financial instability in the market. Both the schemes are of their own importance and have their own kind of nature.